CARES Act Tax Deductions are Available for Your Business!

In March of 2020, during the initial stages of the COVID-19 pandemic, the U.S. government signed the Coronavirus Aid, Relief, and Economic Security, or “CARES” Act. The aim was this bill was to provide tax relief for businesses affected by the coronavirus by applying tax breaks. These CARES Act tax deductions include any upgrades to fire sprinklers, fire alarms, special hazard safety systems, and security that took place during 2020. Organizations like the NFSA pushed for this opportunity, but there is still much to be done about informing business owners.

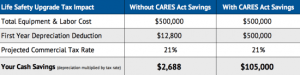

To get a better idea of how the process works, please refer to the table below that shows example figures and their deductibles. Much of the process is accelerated. Normally, the deductions are spread over 39 years, but thanks to Section 168, you can deduct all equipment and labor expenses from the first year.

Table courtesy of American Fire Protection Group Inc.

What is Covered by the CARES Act?

With CARES Act tax deductions available, it is also important to understand what all may qualify. Those who are eligible are based on the following criteria:

- Total replacement of old pipe (Dry Attic or Wet Systems that are corroded/nonfunctional)

- Updating a Dry Valve or Wet Riser Valve

- Updating a Dry System Air Compressor to a Nitrogen Generator

- Upgrading existing sprinkler heads

- Upgrading existing Dry Pendants

- Upgrading an existing underground supply

- Upgrading an existing schedule system to ESFR for today’s storage heights and commodity (insurance companies are now requiring this for commercial business)

- Installing fire protection systems in existing buildings that were previously not protected

- Upgrading fire alarm panels

- Special Hazard Systems Upgrades

A Few More Things to Know

- The CARES Act includes a full tax deduction for equipment and labor costs for life safety system upgrades on commercial properties.

- Savings are retroactive for system upgrades implemented after January 1, 2018.

- There is no maximum purchase amounts.

Next Steps

If you believe that your life safety upgrades qualify, we encourage you to visit home.treasury.gov for more information on what actions your business needs to take to receive its CARES Act tax deductions. Additionally, if you are looking to have your systems upgraded, contact us for a quote.